"“Imagine Max. Max wants to be an entrepreneur. But he does not want to start something from scratch, but rather acquire an existing business. Max is not born to rich parents and has no capital of his own. But he has talent and time - And he knows if some like-minded rich middle aged rich folk were to back his idea financially, they could create huge value together, and split the pie together”

What is a Search Fund?

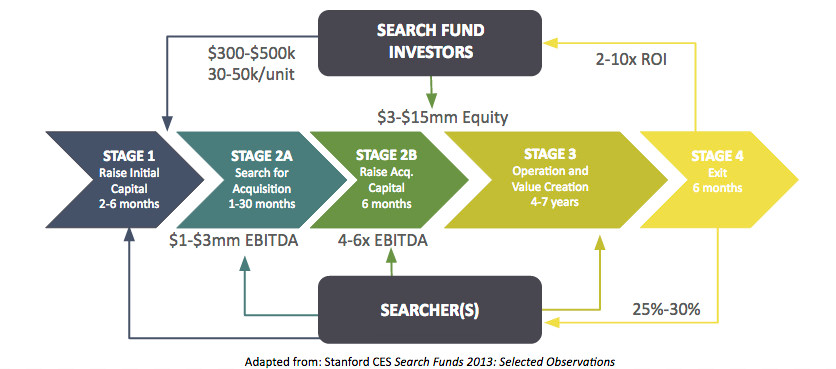

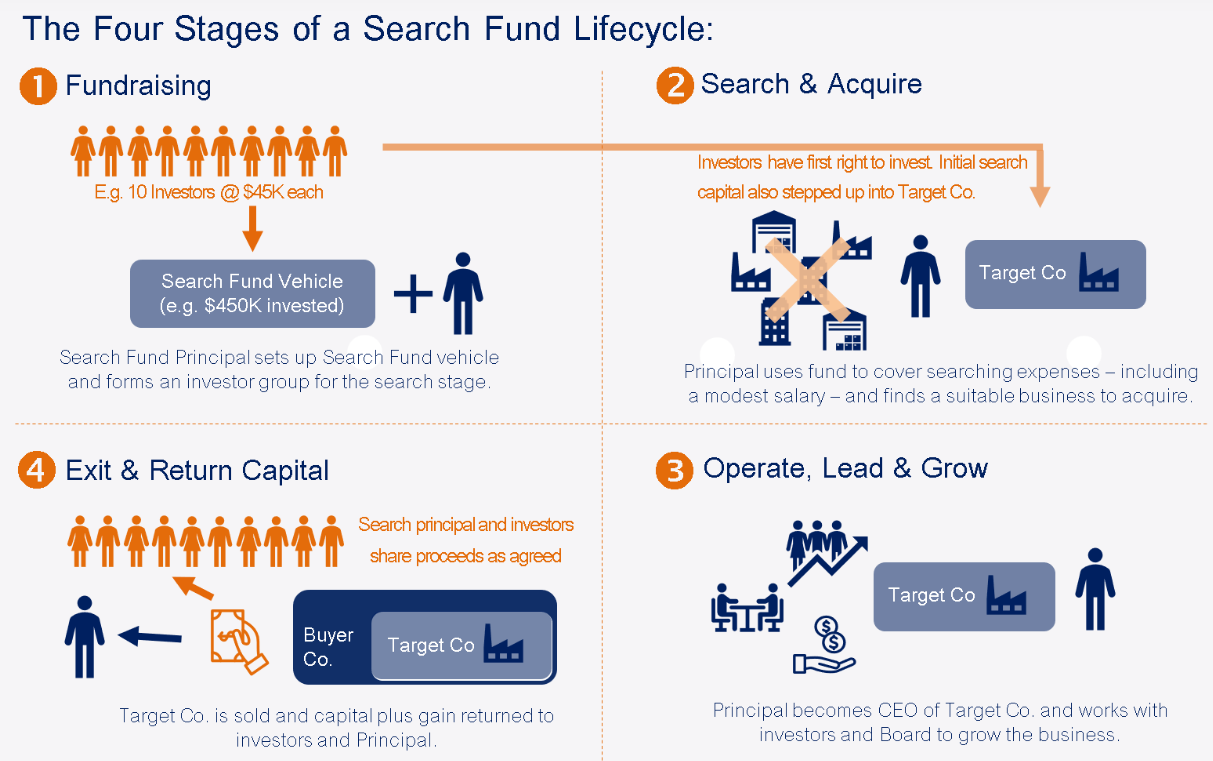

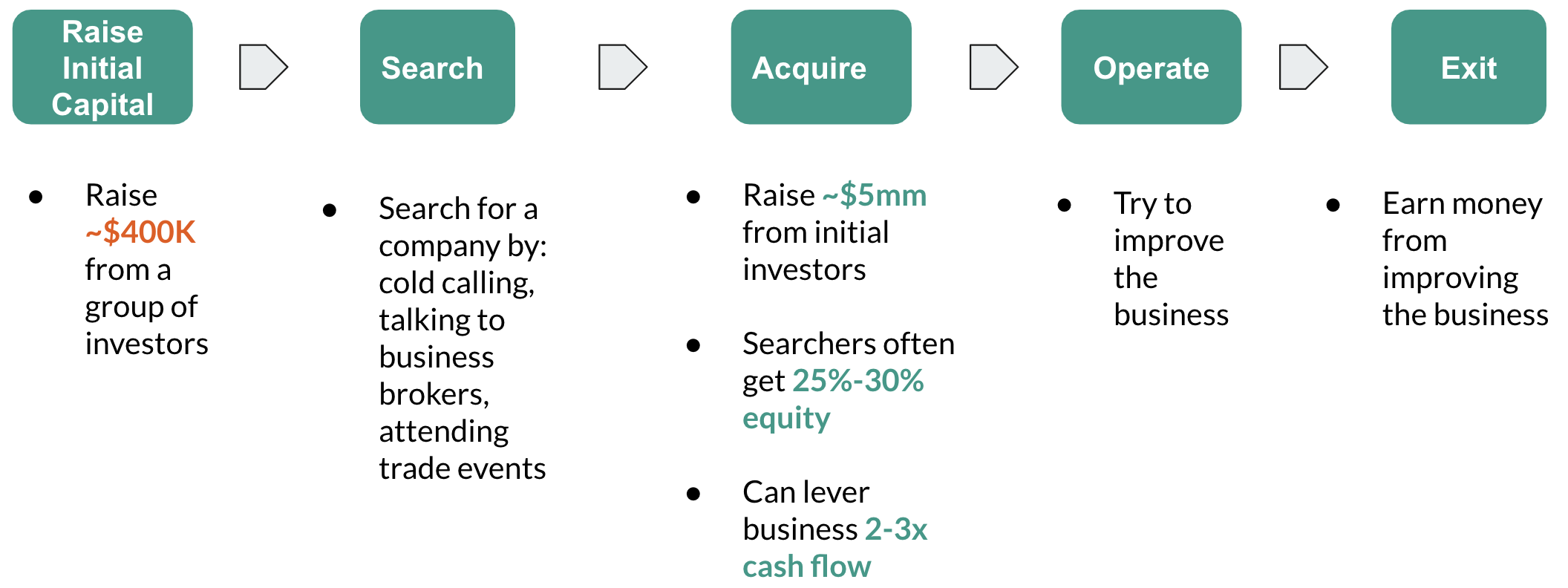

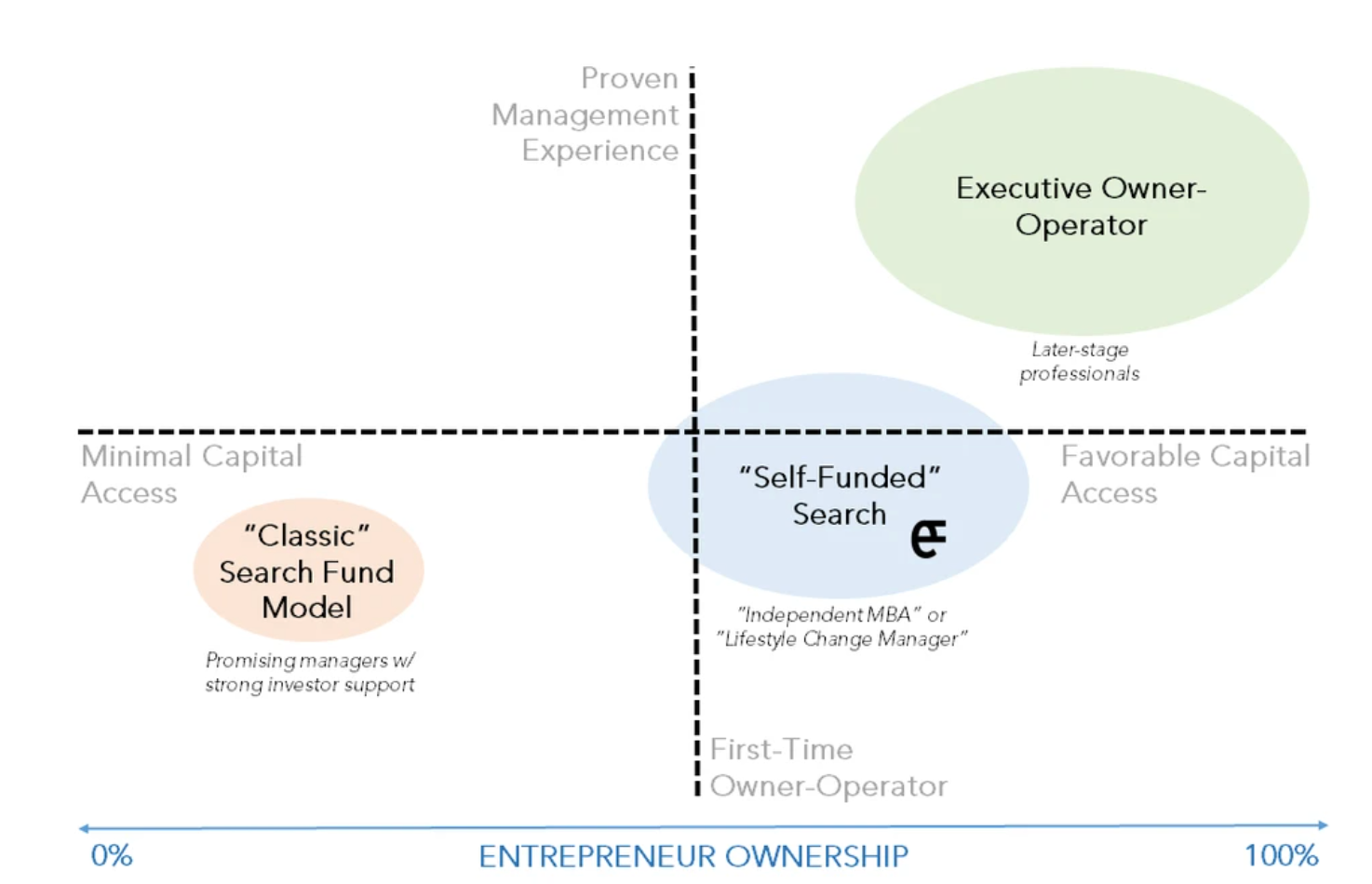

A Search Fund is a two-stage investment model used by entrepreneurs to source acquisition capital. Unlike "fundless" sponsor deals where the entrepreneur seeks investment once he has identified a target, Search Funds sell equity before a target has been found. An entrepreneur will generally raise $350-$500k in a Search Fund to provide runway expenses (stipend, marketing, due diligence, travel, etc) for up to 30 months. In exchange for this up-front equity, the entrepreneur (AKA “Searcher”) is obligated to give his investors a right of first refusal on any deals.(There are normally 12- 16 investors involved with a Search Fund)

Generally, one is searching for a high-quality business with the following characteristics:

- Simple Operations

- History of profits and growth

- Services (Either B2B or B2C)

- EBITDA Margins > 15%

- EBITDA of at least $2m ($2-4m targets)

- 60%+ Contractual Recurring Revenue

- Low Maintenance Capex

- Industry Growth of at least 2x GDP

These characteristics mitigate the operating risk and will allow you flexibility and breathing room as you learn how to operate a business. Additionally, experienced and successful operators and investors will join your board of directors to help you take the already high-quality business to even greater heights

Searchers look into buying a cash flow positive business.

So in summary, the operating flow of the Search Fund model

The ultimate goal of a searcher as well as a search fund investor is to exit the company post 5-7 years since the acquisition.

Private Equity acquires a handful of businesses whereas Search fund aims to acquire only one business. Also in Search Fund the acquirer installs oneself as the CEO whereas in private equity the fund keeps the current management team or finds a new one.

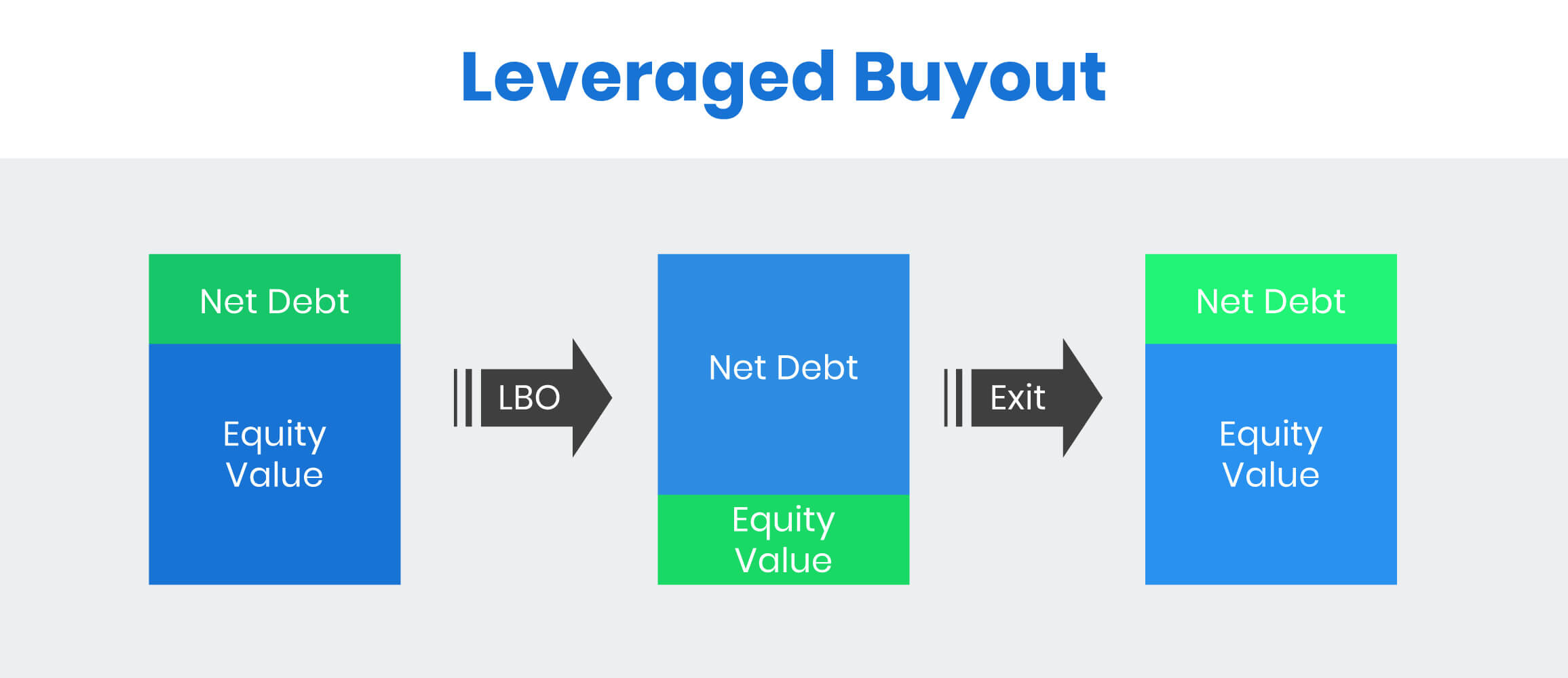

But how can leverage generate returns?

The answer to this lies in a financial engineering concept term called Leveraged Buy-out (LBO).

Leveraged Buy Out (LBO) 101:

A leveraged buyout (LBO) is the acquisition of another company using a significant amount of borrowed money (bonds or loans) to meet the cost of acquisition.

It's kind of similar to a mortgage deal that one undertakes while buying a house. The down-payment that we put up for the house is normally the equity amount, while the loan that we take can be considered as the debt amount.

How does a LBO workout?

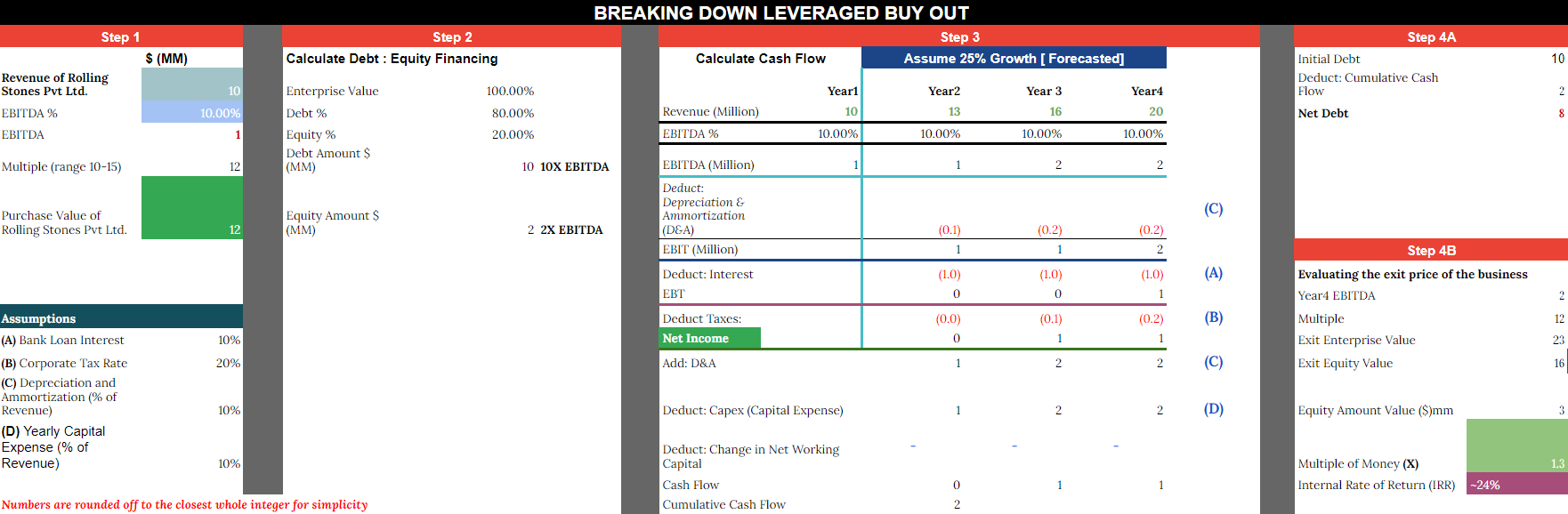

Step 1: Identify the enterprise value of the firm that you're trying to acquire. (Just like when you buy an apartment, one tries to gauge it's property value)

[ a. Revenue x EBITDA Margin % = EBITDA b. EBITDA x [multiple. Normally use 10x - 15x] = Enterprise Purchase Price

Step 2: How much debt and equity are being used to buy the company? (Again similar to buying a house, here we try to identify how much money you will put up from your pocket and how much will be borrowed)

So let's say, we are trying to purchase a company, Rolling Stones Pvt Ltd. They have a revenue of $10MM and EBITDA of $1MM (10% of Revenue). We currently value the company at 12x Ebitda @ $12MM. Now to purchase this, we can use a following deal structure.

Step 3: Forecast Income Statement and Cash Flow (Similar to how we calculate how much money we can earn from renting out our apartment, in this step we normally would try to understand a similar process with the acquired firm). The principal here is we will use generated cash to pay down the debt. (similar way one rents out the house to pay down the mortgage)

Step 4: Calculate debt paydown and returns

Step 4a: How much debt is paid down during the forecast?

Step 4b: How much cash are we getting back on our investment?

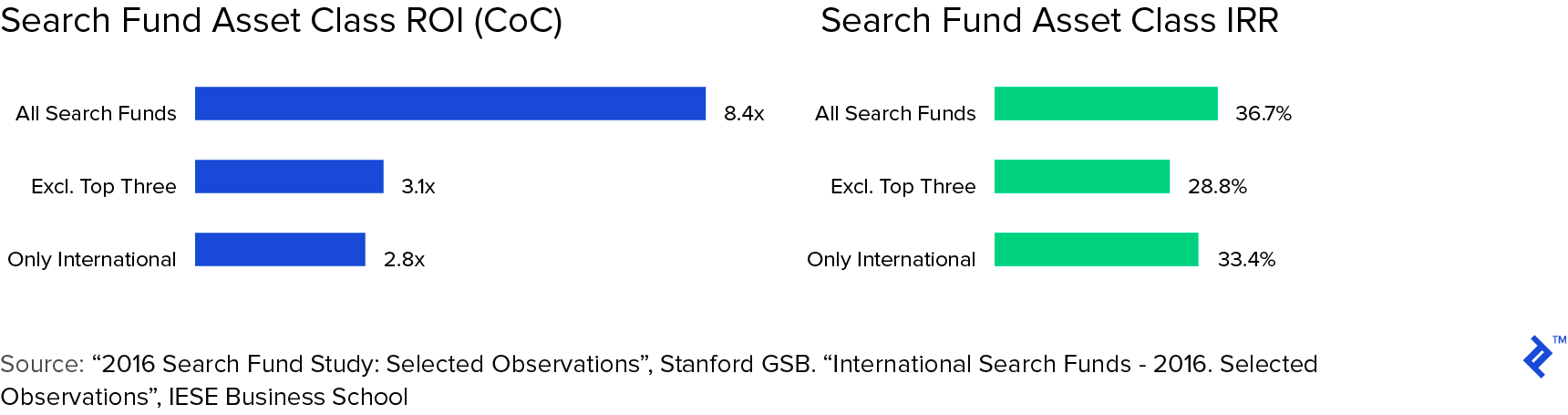

So, what is the return of a Search Fund?

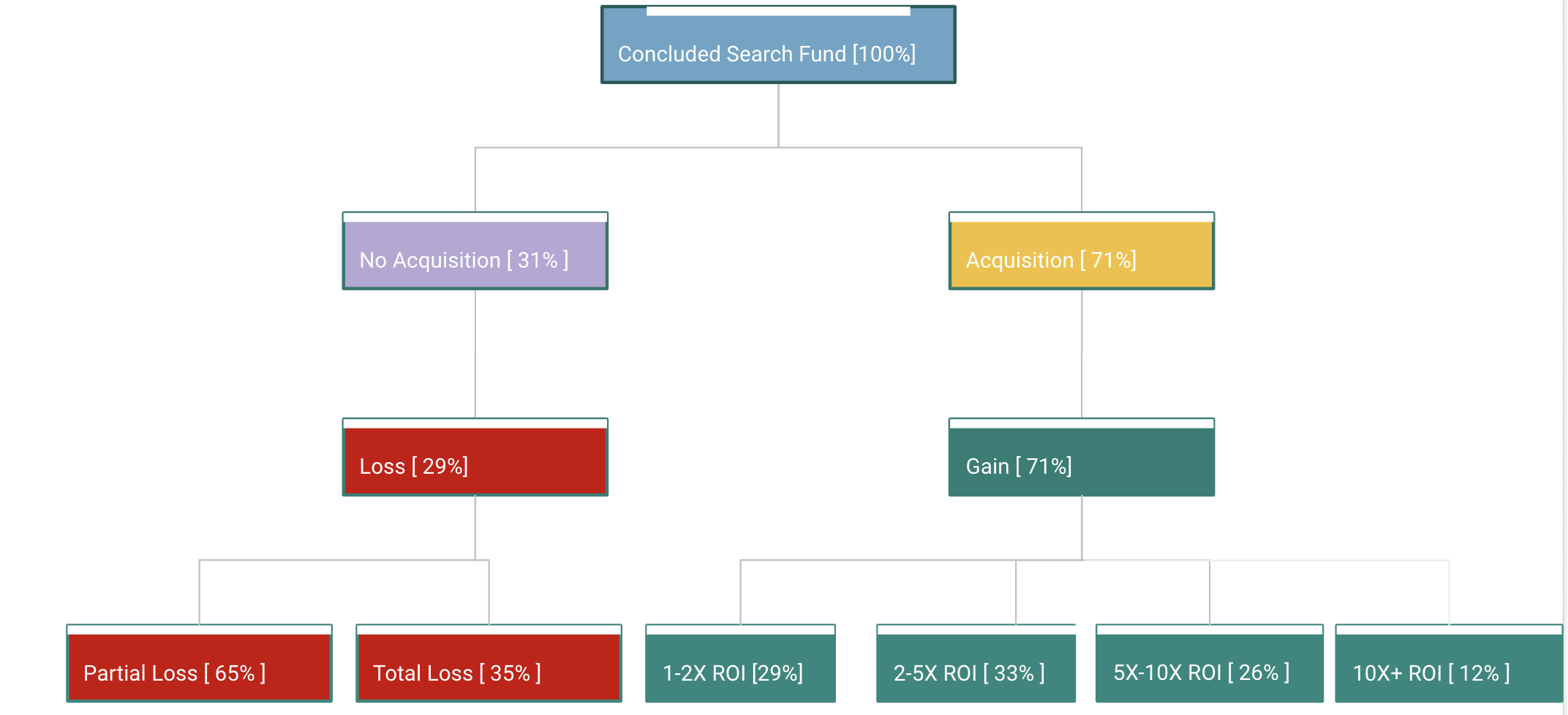

It depends. Following is a classification of the returns of a search fund based on the historical deals.

Historical Returns Breakdown of Search Funds

And what kind of entrepreneurial background do these searchers have?

So the pressing question here is, what makes Search Funds work?

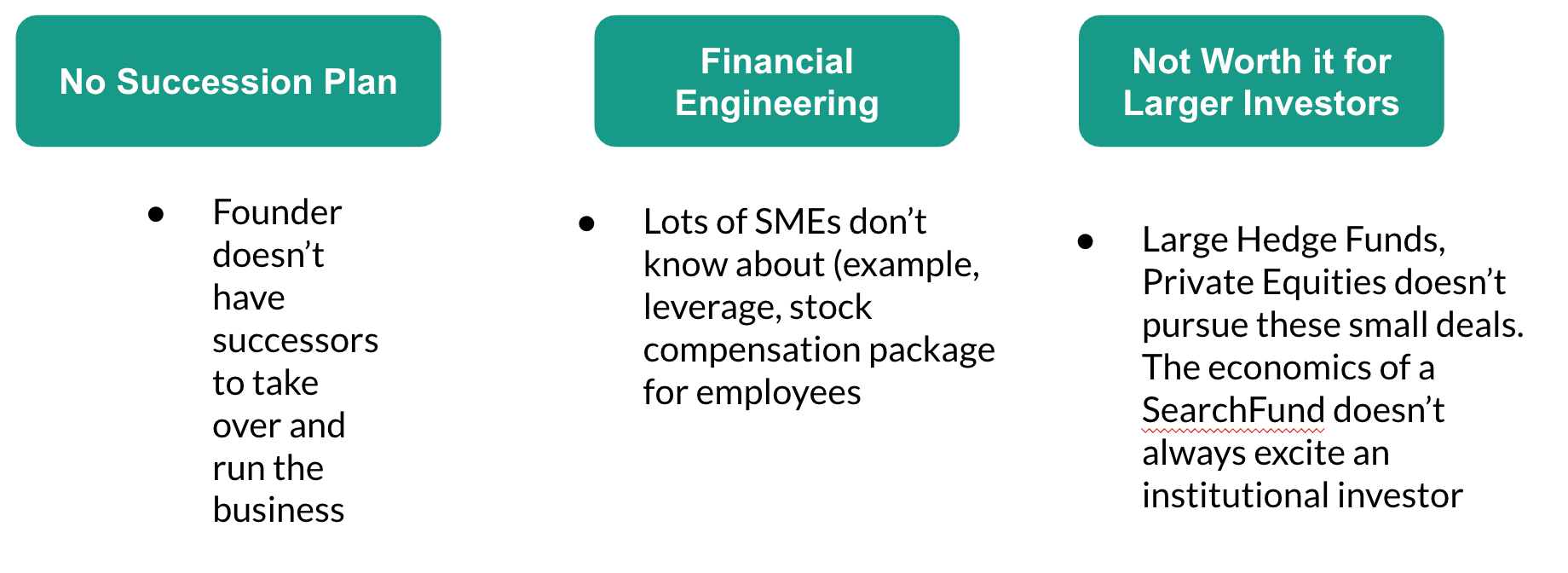

The companies that the Searchers target are not necessarily sexy startups or well-known brand! Many are family firms without a succession plan or companies too small to attract typical investors.

The cons of a Search Fund

- Deal-making is hard - 31% of searchers either can't find a company or make a loss.

- May not have an interest in the target industry

- People management for a company is something that can't be taught purely and it's a hard skill to master. Quoting my Prof. Jan Simmons, regarded as one of the gurus of Search Fund, "Buying the company is one of the easiest part, but running the business is where the challenge lies"

- Often times it's hard to be picky about geography

Overall, Search Fund is a great business model that gives a blend of entrepreneurship and finance. Search Funds have emerged as a new paradigm in entrepreneurship and investing, and it is growing at a speed that typifies the pace of change across the economy at large. This may be the first time you hear about Search Funds, but it certainly won’t be the last.